How to Read a Stock Chart Ma Models

How to Read Stock Charts

If you're going to actively trade stocks equally a stock market investor , then you demand to know how to read stock charts. Even traders who primarily use fundamental assay to select stocks to invest in still often use technical analysis of stock price movement to make up one's mind specific buy, or entry, and sell, or exit, points.

Stock charts are freely available on websites such as Google Finance and Yahoo Finance, and stock brokerages always make stock charts available for their clients. In short, you shouldn't have whatever trouble finding stock charts to examine.

Stock Nautical chart Construction – Lines, Bars, Candlesticks

Stock charts can vary in their structure from bar charts to candlestick charts to line charts to betoken and figure charts. Nigh all stock charts give y'all the choice to switch between the diverse types of charts, every bit well as the ability to overlay diverse technical indicators on a chart. Y'all can likewise vary the time frame shown by a chart. While daily charts are probably the well-nigh normally used, intraday, weekly, monthly, year-to-date (YTD), 5-year, 10-yr, and a complete historical lifetime of a stock are as well available.

There are relative advantages and disadvantages to using different chart construction styles and to using dissimilar time frames for analysis. What manner and time frame will work all-time for yous equally an individual analyst or investor is something that you tin can but observe through actually doing stock chart assay. You can glean valuable indications of probable stock price movement from whatever stock chart. Yous should cull the nautical chart way that makes it easiest for you lot to read and analyze the nautical chart, and trade profitably.

Looking at a Stock Chart

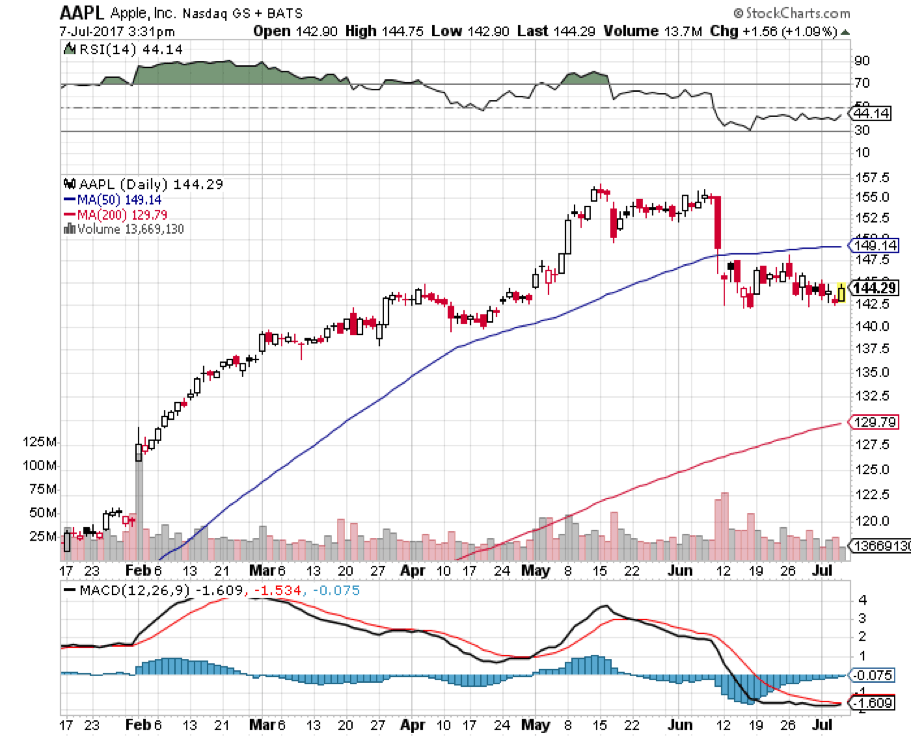

Below is a twelvemonth-to-date daily chart of Apple tree Inc. (AAPL), courtesy of stockcharts.com. This nautical chart is a candlestick chart, with white candles showing upward days for the stock and reddish candles showing downward days. In addition, this chart has several technical indicators added: a 50-period moving average and a 200-period moving average, actualization equally blue and scarlet lines on the chart; the relative strength indicator (RSI) which appears in a dissever window higher up the main chart window; the moving average convergence departure indicator (MACD) which appears in a separate window beneath the chart.

Along the bottom of the main nautical chart window, the daily trading book is shown. Note the large spike in book that occurred on February 1st, when the stock gapped higher and began a strong uptrend which lasted until early June. Too, note the high amount of selling volume (indicated by red book bars which signal days with a greater amount of selling volume than ownership book) that occurs when the stock moves sharply downward effectually June 12th.

The Importance of Volume

Volume appears on well-nigh every stock nautical chart that you'll find. That's because trading volume is considered a critical technical indicator by nearly every stock investor. On the chart in a higher place, in addition to showing the total level of trading volume for each day, days with greater buying volume are indicated with blue bars and days with greater selling book are indicated with red confined.

The reason that volume is considered to be a very of import technical indicator is a elementary one. The vast majority of stock market buying and selling is done past big institutional traders, such as investment banks , and by fund managers, such as mutual fund or substitution-traded fund (ETF) managers. When those investors make major purchases or sales of a stock, it creates high trading volume, and it is that kind of major buying and selling past large investors that typically move a stock higher or lower.

Therefore, individual or other institutional traders watch volume figures for indications of major buying or selling activity by large institutions. This information tin be used either to forecast a hereafter price trend for the stock or to identify cardinal cost support and resistance levels.

In fact, many private investors make up one's mind their buying and selling decisions almost solely based on post-obit the identified deportment of major institutional traders. They buy stocks when book and cost movement indicate that major institutions are ownership, and sell or avoid buying stocks when at that place are indications of major institutional selling.

Such a strategy works best when applied to major stocks that are generally heavily traded. It volition likely be less effective when applied to stocks of small companies that are not yet on the radar screens of big institutional investors and that accept relatively small-scale trading volumes even on days when the stock is more heavily traded than usual.

Bones Volume Patterns

There are iv basic volume patterns that traders typically watch equally indicators.

High volume trading on Up Days – This is a bullish indication that a stock's price volition go on to ascent

Low volume trading on Down Days – This is besides a bullish indication since information technology indicates that on days when the stock's price falls dorsum a fleck, not many investors are involved in the trading. Therefore, such down days occurring in an overall bull market are unremarkably interpreted as temporary retracements or corrections rather than equally indicators of future significant price movement.

High Volume Trading on Downwards Days – This is considered a surly indicator for a stock, as it shows that major institutional traders are aggressively selling the stock.

Depression Book Trading on Upward Days – This is another bearish indicator, although non as strong as high volume trading on down days. The low volume tends to peg the trading activeness on such days as less significant and usually bear witness of merely a short-term counter-trend retracement upward in an overall, long-term surly trend.

Using Technical Indicators

In analyzing stock charts for stock market investing, investors apply a variety of technical indicators to help them more precisely likely price movement, to place trends, and to anticipate market place reversals from bullish trends to bearish trends and vice-versa.

1 of the most normally used technical indicators is a moving average. The moving averages that are most frequently applied to daily stock charts are the xx-day, l-day, and 200-24-hour interval moving average. Generally speaking, equally long as a shorter period moving average is higher up a longer period moving average, a stock is considered to exist in an overall uptrend. Conversely, if shorter term moving averages are below longer term moving averages, so that indicates an overall downtrend.

The Importance of the 200-Mean solar day Moving Boilerplate

The 200-day moving average is considered by well-nigh analysts equally a disquisitional indicator on a stock chart. Traders who are bullish on a stock want to see the stock's price remain above the 200-day moving average. Surly traders who are selling brusque a stock want to see the stock toll stay beneath the 200-day moving average. If a stock'due south cost crosses from below the 200-twenty-four hours moving average to to a higher place it, this is usually interpreted every bit a bullish market reversal. A downside cantankerous of price from above the 200-day moving boilerplate is interpreted as a bearish indication for the stock.

The interplay between the 50-mean solar day and 200-day moving averages is also considered equally a stiff indicator for time to come price move. When the 50-mean solar day moving boilerplate crosses from below to to a higher place the 200-twenty-four hours moving average, this event is referred to by technical analysts as a "aureate cantankerous". A aureate cross is basically an indication that the stock is "gold", set up for essentially higher prices.

On the flip side, if the fifty-twenty-four hours moving average crosses from to a higher place to below the 200-twenty-four hours moving boilerplate, this is referred to by analysts as a "expiry cantankerous". You can probably figure out on your own that a "death cross" isn't considered to bode well for a stock'south future price motion.

Trend and Momentum Indicators

In that location is virtually an endless listing of technical indicators for traders to choose from in analyzing a chart. Experiment with diverse indicators to discover the ones that piece of work best for your particular style of trading, and as applied to the specific stocks that y'all trade. Y'all'll likely find that some indicators work very well for y'all in forecasting cost movement for some stocks merely not for others.

Technical analysts often use indicators of unlike types in conjunction with each other. Technical indicators are classified into two basic types: trend indicators, such equally moving averages, and momentum indicators, such as the MACD or the boilerplate directional alphabetize (ADX) . Trend indicators are used to identify the overall direction of a stock'due south price, up or down, while momentum indicators gauge the strength of price motion.

Analyzing Trends

When reviewing a stock chart, in addition to determining the stock'southward overall trend, upward or down, it's also helpful to look to place aspects of a trend such as the following:

- How long has a trend been in place? Stocks do not stay in uptrends or downtrends indefinitely. Eventually, there are ever trend changes. If a trend has continued for a long menstruation of time without any meaning corrective retracement moves in the opposite management, y'all want to be especially warning for signs of an impending market place reversal.

- How does a stock tend to trade? Some stocks movement in relatively boring, well-divers trends. Other stocks tend to experience more than volatility on a regular basis, with cost making sharp moves up or downwardly even in the midst of a full general long-term trend. If you are trading a stock that typically evidences loftier volatility, then you know non to place too much importance on the trading action in any unmarried day.

- Are at that place signs of a possible tendency reversal? Careful analysis of stock price move often reveals signs of potential trend reversals. Momentum indicators oft signal a trend running out of steam before the price of a stock actually peaks, giving alarm traders the opportunity to get out of a stock at a good price before it reverses to the downside. Various candlestick or other chart patterns are besides often used to identify major market place reversals.

Identifying Support and Resistance Levels

Stock charts tin be particularly helpful in identifying support and resistance levels for stocks. Back up levels are price levels where you lot unremarkably seeing fresh buying coming in to support a stock's price and turn it back to the upside. Conversely, resistance levels represent prices at which a stock has shown a trend to fail in attempting to move higher, turning back to the downside.

Identifying support and resistance levels tin can be especially helpful in trading a stock that tends to merchandise within an established trading range over a long flow of time. Some stock traders , having identified such a stock, will await to purchase the stock at support levels and sell it at resistance levels over and once more, making more and more coin as the stock traverses the aforementioned footing multiple times.

For stocks that have well-identified support and resistance levels, toll breakouts beyond either of those levels can exist of import indicators of futurity price movement. For example, if a stock has previously failed to break above $50 a share, but then finally does so, this may be a sign that the stock volition move from in that location to a essentially college toll level.

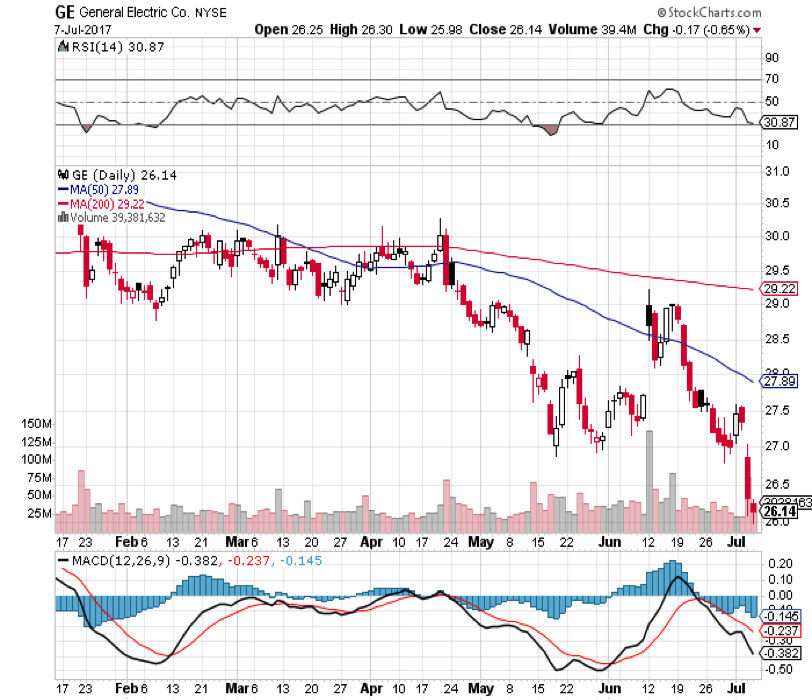

The chart of General Electric (GE) below shows that the stock traded in a tight range between $29 and $30 a share for several months, only once the stock price broke below the $29 support level, it continued to fall substantially lower.

Determination – Using Stock Chart Analysis

Stock chart analysis is non infallible, not even in the hands of the most expert technical analyst. If it were, every stock investor would be a multi-millionaire. Still, learning to read a stock chart will definitely help turn the odds of beingness a successful stock market investor in your favor.

Stock chart analysis is a skill, and like whatever other skill, 1 just becomes an expert at information technology through do. The good news is that nearly anyone willing to work diligently at analyzing stock charts tin become, if not an outright expert, at least pretty good at it – good enough to better their overall profitability in stock market trading. Therefore, it's in your best interest as an investor to begin or keep your education in stock chart analysis.

Additional Resources

Thanks for reading CFI's guide on How to Read Stock Charts. To keep learning and advancing your career, the following resources will exist helpful:

- McClellan Oscillator

- Speed Lines

- Forex Trading

- Investing for Dummies

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/how-to-read-stock-charts/

0 Response to "How to Read a Stock Chart Ma Models"

Postar um comentário